Energy Price Uncertainty and Global Land Use

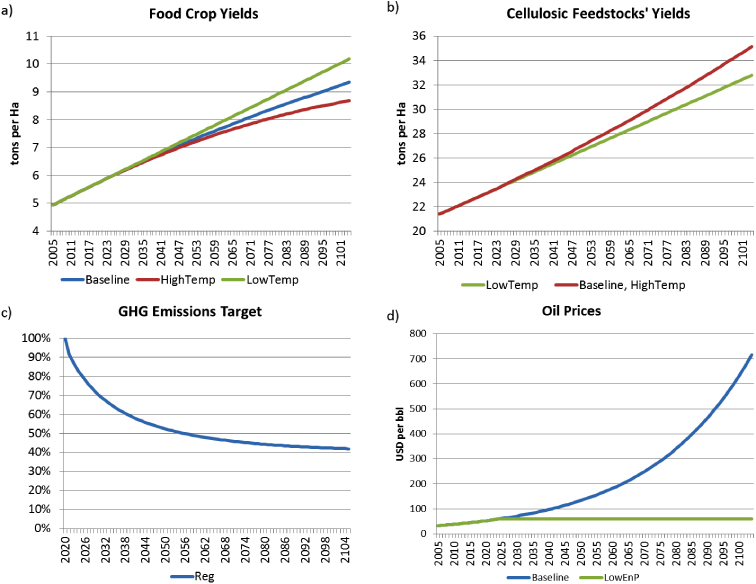

/Global land use research to date has focused on quantifying uncertainty effects of three major drivers affecting competition for land: the uncertainty in energy and climate policies affecting competition between food and biofuels, the uncertainty of climate impacts on agriculture and forestry, and the uncertainty in the underlying technological progress driving efficiency of food, bioenergy and timber production. The market uncertainty in fossil fuel prices has received relatively less attention in the global land use literature. Petroleum and natural gas prices affect both the competitiveness of biofuels and the cost of nitrogen fertilizers. High prices put significant pressure on global land supply and greenhouse gas emissions from terrestrial systems, while low prices can moderate demands for cropland. In this study, we assessed and compared the effects of these core uncertainties on the optimal profile for global land use and land-based GHG emissions over the coming century. FABLE integrates distinct strands of agronomic, biophysical and economic literature into a single, intertemporally consistent, analytical framework, at global scale. Our analysis accounted for the value of land-based services in the production of food, first- and second-generation biofuels, timber, forest carbon and biodiversity.

We have modeled uncertainty in future fossil fuel prices with discrete time, discrete state-space, time-homogenous Markov chain methods. The stochastic process is characterized by a state space and transition matrix describing the probabilities of particular transitions. The states represent whether world is on high, middle (reference path), or low price paths in a given time period. In our modeling, these are exogenous states because we will be using price data provided by EIA and extrapolated into the future.

We found that by mid-century, slowing population growth, coupled with ongoing agricultural productivity growth will likely bring an end to large scale cropland conversion, after which point the worlds land resources will likely become a net carbon sink. There is great uncertainty about the allocation of the worlds land resources in 2100. We have compared the land use impacts of anticipated uncertainty in climate impacts, climate regulation and energy prices and find that energy prices are the most significant source of uncertainty in global land use in 2100. High energy prices encourage more land conversion for biofuels and raise the cost of cropland intensification, while low energy prices have the opposite effect.