FACE-IT

/a Framework to Advance Climate, Economic, and Impact Investigations with Information Technology

Read Morea Framework to Advance Climate, Economic, and Impact Investigations with Information Technology

Read MoreOne of the central problems in understanding climate change is understanding how it will impact the economy. Most current models assume that climate change will reduce usable output. The resulting effects on long term growth under such an assumption are small. If usable output is reduced, there will likely be some reduction in savings and hence capital available in future periods. Nevertheless, the core drivers of growth such as technological development remain. As a result, under most models, the world is an order of magnitude or more richer in several hundred years even if temperature change is extreme and the damages from climate change potentially intolerable. Some models consider the possibility that climate change will directly destroy capital (i.e., such as through destruction of buildings in storms). While growth is somewhat slower in this formulation, the basic result is unchanged.

In this project we consider a simple modification to the standard damage function so that climate change can affect growth. We take a canonical endogenous growth model and modify it so that climate change has an impact on the sectors in the economy that contribute to growth. For example, if an economy is modeled as having an inventing sector and a manufacturing sector, we allow climate damages to affect the output of both sectors. With this simple reformulation, the effects of climate change can be dramatically different than in standard models. Over reasonably long periods, the growth effects dominate, showing that studying the impacts of climate change on growth should be of central concern.

Our goal is to consider this effect in all of the canonical endogenous growth models to see how robust the effect is across model choices. We have solved two models so far and likely will want to consider another two or three. In addition, we are simulating the results of one or more models to understand the likely size of the effects under differing parameter choices.

We are currently extending the social cost of carbon work to consider the relative importance of carbon dioxide (CO2) and methane (CH4) emissions

Read MoreWe are working on robust control in simple climate models coupled with economic growth, finance, and macro models. This effort is important for carbon pricing, understanding the impacts of robustly accounting for climate change, technical change, and other sources of uncertainty, not only on economic growth and macroeconomics, but also on asset prices as well as insurance pricing and green-house gas emission pricing.

Within the context of climate models are three contrasting approaches to robustness:

Decision theoretic frameworks exist for all of these applications, but their full consequences for economic models with climate change remains to be explored. To accomplish this we are developing numerical methods to support these analyses. In terms of discounting, our focal point is on the consequences of uncertainty. There is an extensive literature from asset pricing and macroeconomics that uses stochastic discounting as a device to adjust discount rates for cash flow riskiness. We are drawing on this literature and incorporating compensations for aversion to ambiguity and concerns about model misspecification into models that feature explicit uncertainty and climate impacts on the economy. We are also contrasting pricing implications from market economies with social valuation.

Coupled Economic-Climate Models with Carbon-Climate Response: The economics of global climate change is characterized by fundamental uncertainties including the appropriate reduced forms for climate dynamics, the specification of economic damages resulting from climate change, and mechanisms by which these damages will affect long-run economic growth. We have developed and implemented a novel theoretical and computational integrated assessment modeling approach that is a well-grounded means of summarizing the fundamental relationship between human activity and the global climate for purposes of economic analysis. Using a dynamic integrated assessment framework, this project makes several contributions to improving the analysis of these uncertainties:

We then develop and study a simple analytical model that yields insights and results on the key implications of these assumptions, as well as facilitating the interpretation of numerical results from a more general model. Among our findings is that the presence of robustness may result in either a decrease or increase in the optimal carbon tax and energy usage, depending among other factors on societal preferences.

Numerical Methods: In order to perform robustness analysis over a variety of fundamentally different models, we are developing PDE-based numerical method for solving robust stochastic equilibrium models in continuous time with optimal control. This approach allows us to uncover solutions for the entire state space and to perform a quick sweep over variety of models and parameters.

Evan Anderson | William Brock | Lars Hansen | Alan Sanstad | Victor Zhorin

Energy modeling, numerical modeling based on economic principles, has become the dominant analytical tool in U.S. energy policy. Energy models are widely used by researchers across the public and private sectors. However, the widespread application of these models in policy analysis poses challenges to decision-makers. We are developing a framework and analysis that demonstrate how non-Bayesian decision rules can address fundamental model uncertainty in the domain of energy policy, technological change, and greenhouse gas abatement.

Numerical modeling based on economic principles has become the dominant analytical tool in U.S. energy policy. Energy models are now used extensively by public agencies, private entities, and academic researchers, and in recent years have also formed the core of integrated assessment models used to analyze the relationships among the energy system, the economy, and the global climate. However, fundamental uncertainties are intrinsic in what has become the typical circumstance of multiple models embodying different representations of the energy-economy, and producing different policy-relevant outputs that model users are compelled to interpret as equally plausible and/or valid. Because the policy implications of these outputs can diverge substantially, policy-makers are confronted with a significant degree of model-based uncertainty and little or no guidance as to how it should be addressed.

This problem of “model uncertainty” has recently been the focus of work in macroeconomics, where scholars have studied the problem of how a decision-maker should proceed in the face of uncertainty re- garding the correct model of an economic system that is the object of policy. We focus on analyzing a low-dimensional numerical integrated assessment model using the “minimax regret” metric. Specifically, we have demonstrated that deep uncertainty regarding energy-related technological change can be addressed using this approach. Our findings include comparison with expected cost minimization, to show how the interaction of solution methods and model structure affect the influence of this form of deep uncertainty on low-run CO2 emissions abatement policies. We also examined other methods assuming some prior distribu- tions over uncertain parameters for analyzing the difference between our robust solution and the non-robust solution from those methods.

We demonstrate that the fundamental model uncertainty can be represented and analyzed in the context of energy policy problems determining optimal CO2 abatement strategies. The robust solution from min-max regret method is significantly different with any solutions from sensitivity analysis over uncertain parameters or those methods assuming prior distributions over uncertain parameters. The following figure shows the difference of the robust min-max regret solution over all three uncertain parameters (the red line) and others with min-max regret solution over only one uncertain parameter, Technical Change level, while the other two parameters are used for sensitivity analysis.

Abatement paths in computational model of min-max regret criterion with three uncertain parameters, and sensitivity analysis of min-max regret criterion with only one uncertain parameter

Forest, Agriculture, and Biofuels in a Land use model with Environmental services (FABLE)

Read MoreThe social cost of carbon, defined as the present value change in consumption due to an incremental change in carbon emissions, is used by federal agencies in cost-benefit analysis of any regulation that changes emissions. In 2009, the Oce of Management and Budget, through an interagency process, estimated the social cost of carbon and required all agencies to use their estimate. Their central value was $21.40/tCO2 with range of -$2.7/tCO2 to $142.4/tCO2.

The government’s estimate of the social cost of carbon, which is consistent with estimates by private researchers, implicitly assumes that the economic growth continues even with substantial temperature increases. In one of the models, temperatures increase by 6.3 by the year 2300. With this temperature increase, the global economy is roughly 30 times larger than it is today on a per capita basis for the model. The apparent reason for this estimate is that damages from climate change do not affect growth. They are modeled as reducing usable output in a given year with exogenously specified growth continuing regardless of climate damages.

We estimate the social cost of carbon when climate change reduces the growth rate of the economy. We use the same model as the OMB but modify it so that a fraction of damages from climate change affect the growth rate rather than simply reducing usable output. Growth might be reduced, for example, because resources are diverted from research to adaptation to climate change. Even relatively small growth effects produce substantial change in the social cost of carbon suggesting that (1) the estimates of the social cost of carbon are not robust to modest changes in the estimating model and (2) research into the impacts of climate change should focus on growth effects rather than level effects.

Estimates of the social cost of carbon when accounting for climate damages.

Current: Elisabeth Moyer | Michael Glotter | Raymond Pierrehumbert | David Weisbach | Nathan Matteson

Alumni: Mark Woolley | Runnan Yang

There is great uncertainty about the impact of anthropogenic carbon on future economic wellbeing.

We use DSICE, a dynamic stochastic general equilibrium (DSGE) model of integrated climate and economy to account for abrupt and irreversible climate change. DSICE is an extension of the DICE2007 model of William Nordhaus, which incorporates beliefs about the uncertain economic impact of possible climate tipping events and uses empirically plausible parameterizations of Epstein-Zin preferences to represent attitudes towards risk.

In this series of studies we model climate shocks in the form of a stochastic tipping points, and investigate the impact of a tipping point externality on optimal mitigation policy. We find that the uncertainty associated with anthropogenic climate change imply carbon taxes much higher than implied by deterministic models. This analysis indicates that there is much greater urgency to immediately enact significant GHG policies than implied by DICE2007 and similar models that ignore uncertainty.

THE BASELINE CARBON TAX IN THE DETERMINISTIC DICE MODEL (WITH NO TIPPING POINT) IS SHOWN IN BLACK. THE EXPECTED ADDITIONAL CARBON TAX WHEN INCLUDING A STOCHASTIC TIPPING POINT IS INDICATED IN BLUE. RED LINES INDICATE THE ADDITIONAL CARBON TAX WHEN THE EXPONENT OF THE DAMAGE FUNCTION IN THE DETERMINISTIC DICE MODEL IS INCREASED TO FOURTH (SOLID LINE) AND SIXTH (DASHED LINE) ORDER. REPRODUCED FROM (LONTZEK ET AL 2015)

The Community Integrated Model for Energy and Resource Trajectories for Humankind (CIM-EARTH) is an open-source modeling framework that allows for the easy specification of computable general equilibrium models, running the resulting simulations, and analyzing the results. This framework is meant to increase both the quality and transparency of integrated assessment modeling by providing open source modeling tools that incorporate the most modern computational methods.

Frameworks:

The AMPL-Source CIM-EARTH Framework (ASCEF) is a first version of the CIM-EARTH framework.

To facilitate adoption and the integration of advanced data processing and analysis services, we undertook an effort to move the implementation from AMPL to C++ and to adopt standard input and output formats. The result is what we call the Open-Source CIM-EARTH Framework (OSCEF).

Models:

CE-Trade: The trade model is used for studying the impacts on international trade of policies relevant to carbon mitigation. In particular, this model is used to assess carbon leakage and mechanisms such as border tax adjustments to reduce leakage.

CE-Energy: The energy model expands core capabilities of CIM-EARTH in order to represent the energy sector in ways more appropriate for policy analysis> The model disaggregated the representation of the U.S. electric power system to include renewable and non-renewable sources, peak and base-load power, and transmission.

CE-Bio: The bio model simulates the economics and lifecycle of biofuel production and use, including a detailed representation of the biofuels market, agriculture, and related services.

CE-Life: The distributional impacts model disaggregates the US consumers in the CE-Trade model by income and age, resulting in a model with 720 distinct consumers.

Structure of the production functions in the baseline CE model:

NOTE: Each node represents a production function. Nodes with vertical line inputs use Leontief functions; the other nodes are labeled with their elasticities of substitution. Table 2 shows the elasticities of substitution between domestic and imported commodities and the Armington international trade elasticities.

Studies:

Unilateral carbon taxes, border adjustments, and carbon leakage.

Analytical general equilibrium effects of energy policy on output and factor prices.

Modeling of Land-Use Changes and Other Indirect Effects of Biofuel Production in CIM-EARTH.

Impact on US Gasoline Prices of Eliminating Biofuels Production: An Equilibrium Analysis

People

Fernando Perez Cervantes | Sou Cheng Choi | Joshua Elliott | Ian Foster | Don Fullerton | Kenneth Judd | Gita Khun Jush | Samuel Kortum | Margaret Loudermilk | Elisabeth Moyer | Todd Munson | Nirupama Rao | David Weisbach

Publications

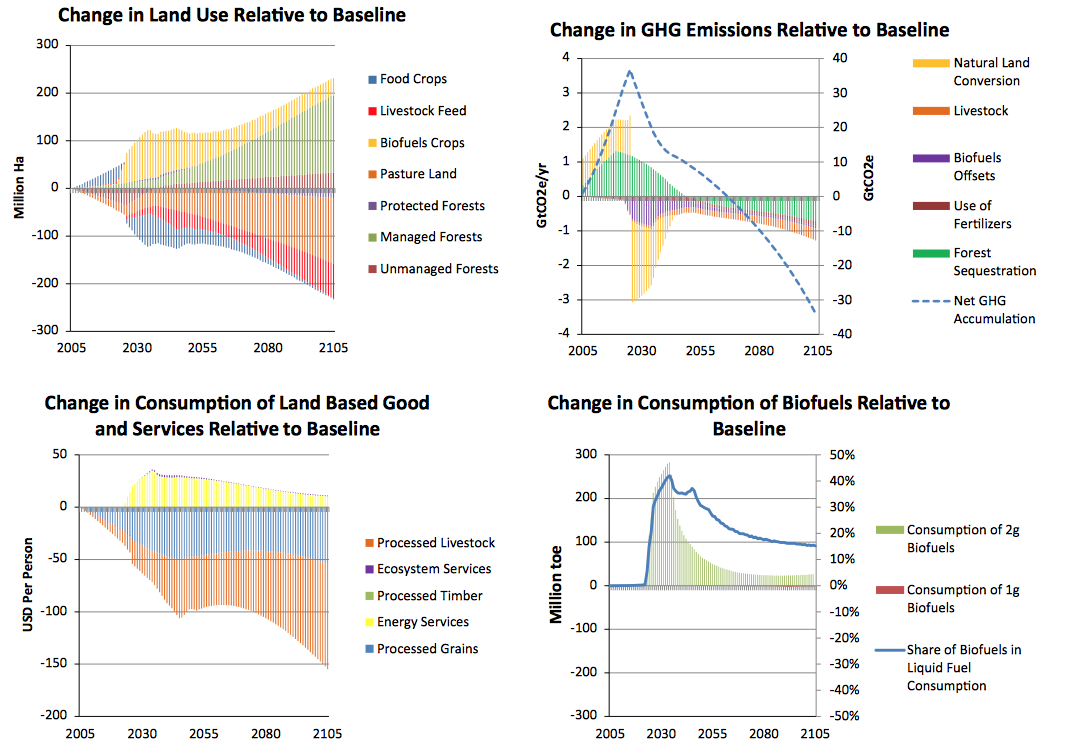

Global land use research to date has focused on quantifying uncertainty effects of three major drivers affecting competition for land: the uncertainty in energy and climate policies affecting competition between food and biofuels, the uncertainty of climate impacts on agriculture and forestry, and the uncertainty in the underlying technological progress driving efficiency of food, bioenergy and timber production. The market uncertainty in fossil fuel prices has received relatively less attention in the global land use literature. Petroleum and natural gas prices affect both the competitiveness of biofuels and the cost of nitrogen fertilizers. High prices put significant pressure on global land supply and greenhouse gas emissions from terrestrial systems, while low prices can moderate demands for cropland. In this study, we assessed and compared the effects of these core uncertainties on the optimal profile for global land use and land-based GHG emissions over the coming century. FABLE integrates distinct strands of agronomic, biophysical and economic literature into a single, intertemporally consistent, analytical framework, at global scale. Our analysis accounted for the value of land-based services in the production of food, first- and second-generation biofuels, timber, forest carbon and biodiversity.

We have modeled uncertainty in future fossil fuel prices with discrete time, discrete state-space, time-homogenous Markov chain methods. The stochastic process is characterized by a state space and transition matrix describing the probabilities of particular transitions. The states represent whether world is on high, middle (reference path), or low price paths in a given time period. In our modeling, these are exogenous states because we will be using price data provided by EIA and extrapolated into the future.

We found that by mid-century, slowing population growth, coupled with ongoing agricultural productivity growth will likely bring an end to large scale cropland conversion, after which point the worlds land resources will likely become a net carbon sink. There is great uncertainty about the allocation of the worlds land resources in 2100. We have compared the land use impacts of anticipated uncertainty in climate impacts, climate regulation and energy prices and find that energy prices are the most significant source of uncertainty in global land use in 2100. High energy prices encourage more land conversion for biofuels and raise the cost of cropland intensification, while low energy prices have the opposite effect.

The allocation of the world’s land resources over the course of the coming century has become a pressing research question. Continuing population increases, improving, land-intensive diets among the poorest populations in the world, increasing production of biofuels and rapid urbanization in developing countries are all competing for land even as the world looks to land resources to supply more environmental services. The latter include biodiversity and natural lands, as well as forests and grasslands devoted to carbon sequestration. And all of this is taking place in the context of faster than expected climate change which is altering the biophysical environment for land-related activities. This combination of intense competition for land, coupled with highly uncertain future productivities and valuations of environmental services, gives rise to a significant problem of decision making under uncertainty. The issue is compounded by the inherent irreversibility of many land use decisions.

The goal of this study is to determine the optimal profile for global land use in the context of growing commercial demands for food and forest products, increasing non-market demands for ecosystem services, and more stringent greenhouse gas (GHG) mitigation targets. We do so by developing a new model, nick-named FABLE: forest, agriculture, and biofuels in a land use model with environmental services. This model determines the optimal allocation of scarce land, both across competing uses as well as across time. While market failures, including ill-defined property rights, poorly developed land markets, lack of information, and credit constraints preclude such a path from being achieved in reality, this optimal path is a useful point of reference for those seeking to influence patterns of global land use. The resulting long-run, forward-looking, computable partial equilibrium model, covers key sectors drawing on the world’s land resources, and incorporates growing demands for food, renewable energy, and forest products, as well as non-market demands for ecosystem services. We also consider alternative GHG constraints, as well as the potential impacts of climate change itself on the productivity of land in agriculture, forestry and ecosystem services.

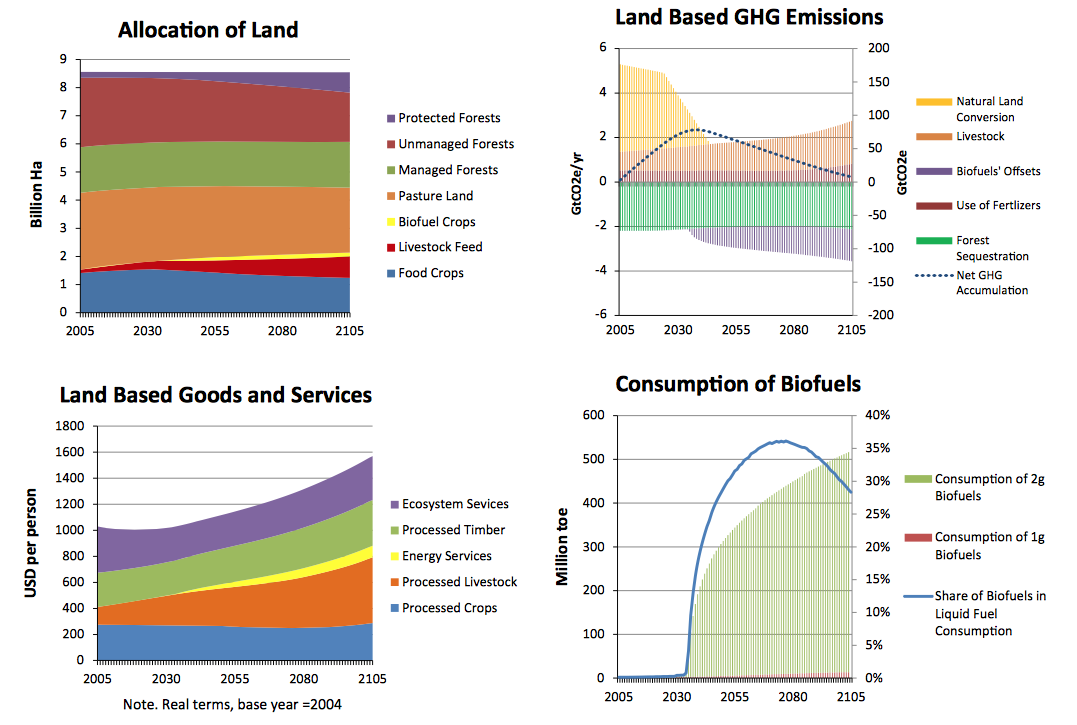

Our baseline reflects developments in global land use over the 10 years that have already transpired, while also incorporating long-run projections of population, income and demand growth from a variety of international agencies. The model baseline suggests that, even in the absence of GHG regulations, deforestation rates associated with cropland expansion decline along the optimal land-use trajectory in the medium term. This is important, since deforestation accounts for a large share of current global GHG emissions. In the long term there is a significant expansion of the livestock sector, driven by increasing per capita incomes, and this is fueled by increasingly intensive production practices. The area of protected natural lands, which deliver valuable ecosystem services, also increases strongly in the long run. However, this finding is sensitive to the choice of social discount rate. A higher rate of discount results in a sacrifice of forest cover and ecosystem services in favor of more immediate delivery of services from food and energy consumption. Along the baseline, the consumption of biofuels increases rapidly after second generation biofuels become commercially viable in 2035, and provides for about a third of total liquid fuel consumption by the end of this century, along the optimal path under our baseline scenario.

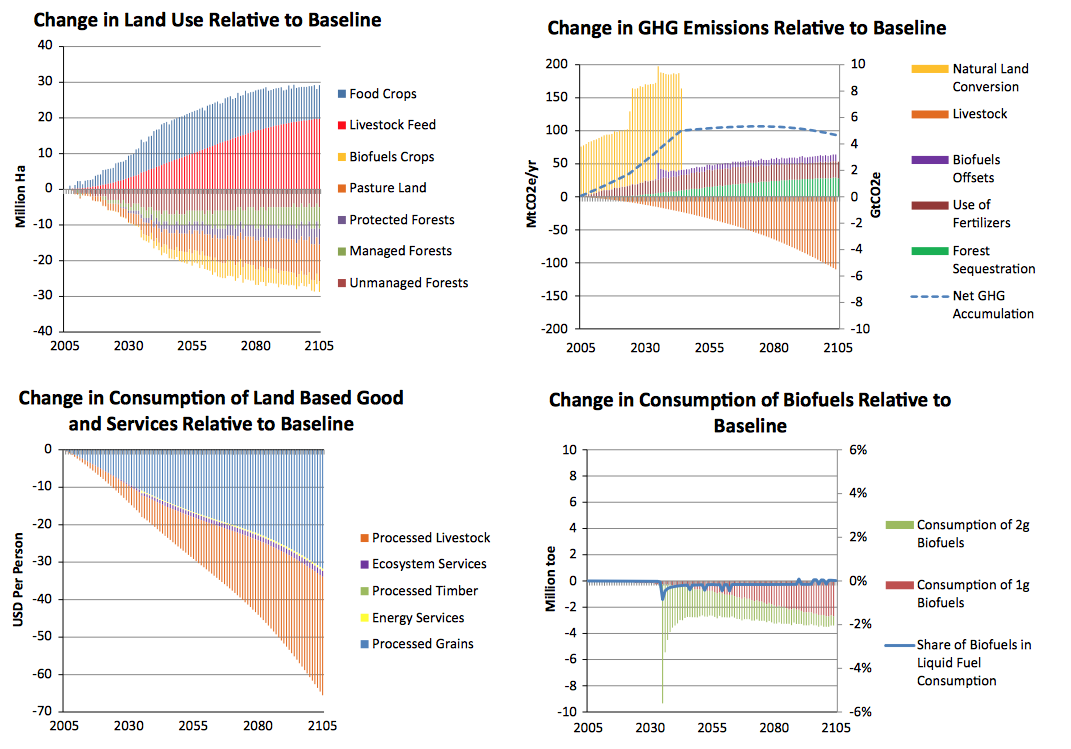

We consider three counterfactual scenarios aimed at capturing the most important sources of uncertainty associated with this long run trajectory for global land use, climate impacts on agriculture, energy prices, and global GHG emissions regulations.

Adverse climate impacts on crop yields curtail food production, requiring additional cropland and encouraging additional fertilizer use, thereby leading to higher GHG emissions.

Energy prices affect the optimal deforestation rate as well as the overall amount of land used in agriculture.

By mid-century, cropland area increases sharply under higher energy prices, due to the incentive for increased biofuel production as well as higher fertilizer prices which raise the cost of intensification.

Substantially more deforestation occurs under this scenario and the increased GHG emissions from land use change outweigh the emissions fall from displacement of petroleum consumption by biofuels and declining fertilizer use.

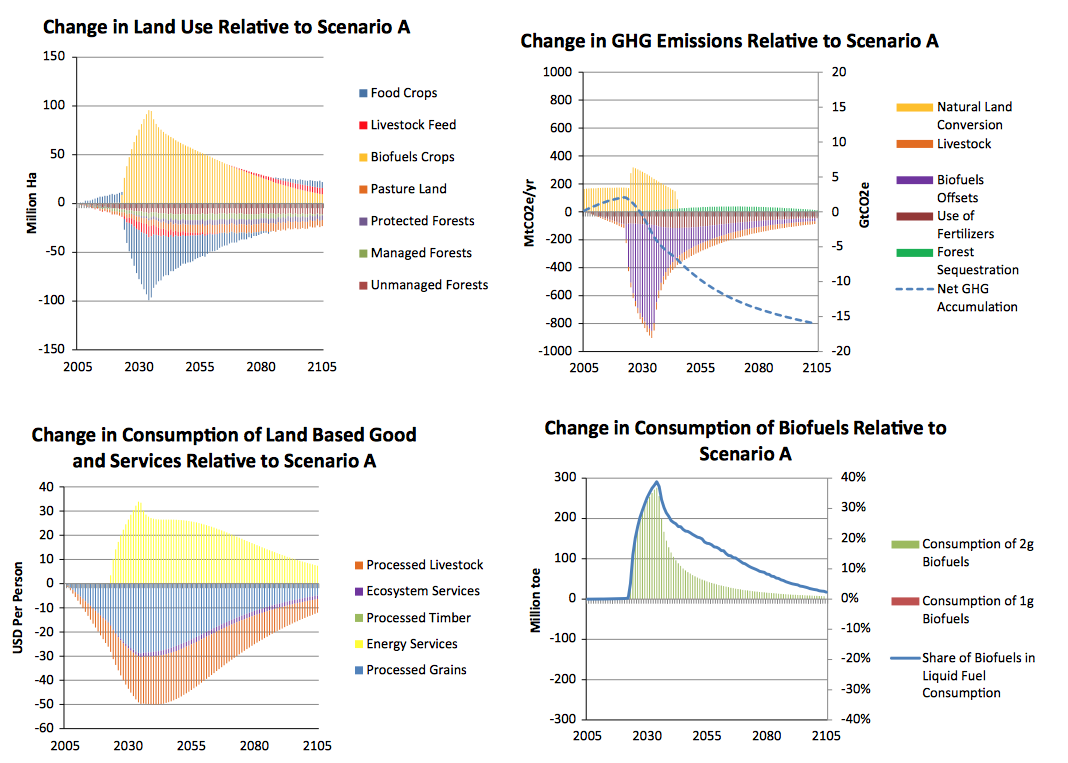

When we also require the world’s land base to deliver land-based GHG abatement, the pressure on global natural land resources becomes even more significant.

While the introduction of the land based GHG emissions constraint leads to a significant reduction in GHG emission flows over the twentyfirst century, its effectiveness is eroded by a substantial increase in GHG emissions after the policy is announced, but before the policy is actually implemented.

This mimics the ‘green paradox’ found in other areas of environmental regulation. Since such pre- announcement seems inevitable from a political-economic perspective, it is an issue which deserves greater attention. Indeed, we find a leakage rate of 56%, which is very high and threatens to undo most of the GHG mitigation benefits of such a policy.

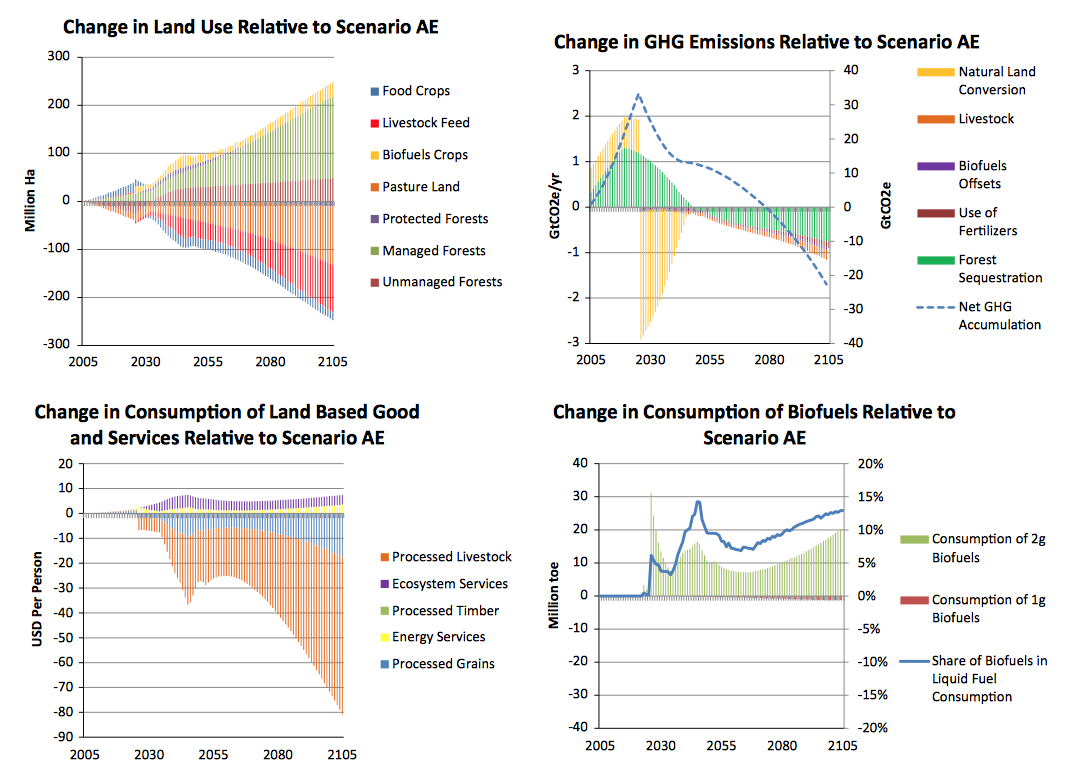

When all three ‘scenarios’ are simultaneously realized, the world’s land resources face a ‘perfect storm’ in which the cost of agricultural intensification is higher, biofuels expand their area, additional cropland is needed to offset the adverse impacts of climate change, and climate regulation also places new pressures on land availability for food. In this case the optimal path of food consumption is significantly lower, highlighting the potential for intense competition for land in the production of the world’s food, fuel and environmental services over the twentyfirst century.

Jevgenijs Steinbuks | Thomas W. Hertel